This can be especially impactful from a working capital perspective, as more extended collection periods mean that companies might face difficulties in managing their short-term obligations. Industries such as banking (specifically, lending) and real estate construction usually aim for a shorter average collection period as their cash flow relies heavily on accounts receivables. On the other end of the spectrum, businesses that offer scientific R&D services can have an average collection period of around 70 days. The Average Collection Period formula calls for calculating the average accounts receivable balance and net credit sales for a specified timeframe. The average accounts receivable is determined by taking the sum of the beginning and ending balances, then dividing that amount by two.

What does a low average collection period indicate?

- It’s essential to understand these dynamics when analyzing a company’s average collection period, comparative to its industry peers.

- This way, you’ll get more nuanced, actionable insights that can fuel business growth.

- Therefore, management often carefully monitors the ACP as part of their overall performance assessment.

- Companies should review their average collection period regularly, ideally monthly or quarterly, to quickly identify and address any potential issues in credit policies, collections processes, or cash flow.

- In 2020, the company’s ending accounts delinquent( A/ R) balance was$ 20k, which grew to$ 24k in the posterior time.

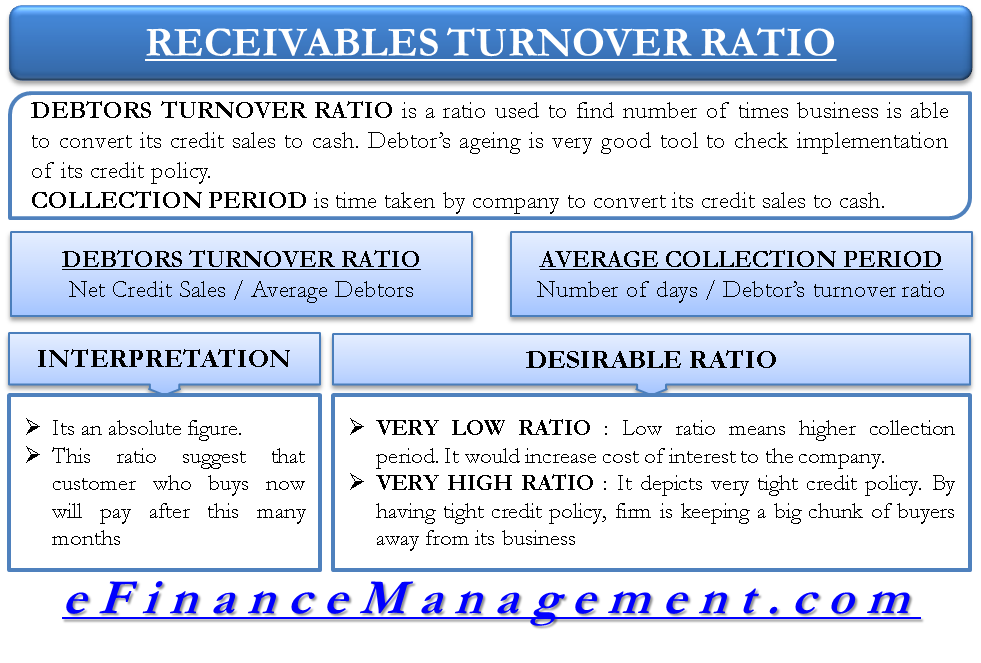

- Key performance metrics such as accounts receivable turnover ratio can measure your business’s ability to collect payments in a timely manner, and is a reflection of how effective your credit terms are.

Understanding the significance of an efficient collections process lies in its ability to ensure a company’s liquidity and short-term financial health. A shorter average collection period means a faster conversion of accounts receivables into cash, allowing for improved credit management and better cash flow control. Additionally, companies with a low average collection period are generally perceived as financially stable and well-managed.

Order to Cash

A lower DSO reflects a shorter time to collect receivables, indicating better business operation. However, a higher DSO may suggest problems in the company’s collection processes or credit policies. By the same token, the average collection period also provides insights into the effectiveness of the collections department. A longer collection period might indicate lax collection efforts, inefficient collections procedures, or poorly trained staff. On the other hand, a shorter average collection period not only signifies an efficient collections department but also a strong follow-up mechanism to ensure timely payment.

Stricter Credit Policies

Net credit sales are calculated as total sales made on credit minus any discounts or returns during the same period. You can also keep track of payments with visual reports, allowing you to manage outstanding invoices proactively. Efficient management can be achieved by regularly monitoring the accounts receivable collection period. Businesses can spot any payment issues quickly and take action to improve the situation, improving their total net sales and ability to manage accounts receivable balances. The Accounts Receivable Turnover ratio provides insights into a company’s efficiency in collecting debts.

Assessing Collections Department Effectiveness

Implicit in these considerations is the understanding that average collection periods are influenced by both internal and external factors. While a business can influence some aspects, such as their credit terms or business model, others, like industry norms, are outside of their control. It’s essential to understand these dynamics when analyzing a company’s average collection period, comparative to its industry peers. The terms of credit extended to customers also play an integral part in determining the collection period. A business that offers extensive credit terms, such as ‘net 90 days’, will naturally have a longer average collection period than a business that insists on ‘net 30 days’.

Operating Income: Understanding its Significance in Business Finance

Also, construction of buildings and real estate sales take time and can be subject to delays. So, in this line of work, it’s best to bill customers at suitable intervals while keeping an eye on average sales. 💡 To calculate the average value of receivables, sum the opening and closing balance of your required duration and divide it by 2. You can also open the Calculate average accounts receivable section of the calculator to find its value.

It increases the cash inflow and proves the efficiency of company management in managing its clients. An organization that can collect payments faster or on time has strong collection practices and also has loyal customers. However, it also means that they follow a very strict collection procedure which may also drive away customers because they prefer suppliers who have more flexible credit terms.

By analyzing industry trends, setting appropriate credit policies, and adapting to external factors, organizations can effectively balance efficiency, profitability, and customer satisfaction. The average collection period for a company helps it determine the time taken in days by a company to convert its trade receivables into cash. It determines a company’s debt collection soundness and helps it formulate and maintain a credit policy. A low number of average collection days is considered good because it implies that the company can quickly retrieve the funds from the trade receivables.

On the other hand, overly strict policies could deter potential customers, so it’s a delicate balance. Implementing stricter credit policies is one way you might optimize your average collection period. This could involve setting more stringent requirements for extending credit to customers, such as conducting rigorous credit checks, asking for upfront deposits or shorter payment terms. The average collection period’s impact extends to the overall stability and growth of a business. Ideally, a company strives to maintain a balance where it can collect its receivables quickly and defer its payables for as long as possible. The company may struggle to meet its financial obligations, potentially affecting its creditworthiness and ability to attract further investment.

The average collection period is the time it takes for a business to collect payments from its customers after a sale has been made. Businesses aim for a lower average collection period to ensure they have enough cash to cover their expenses. It is essential for organizations to consistently monitor their average collection period and adapt their credit policies accordingly.

The AR figure is an important aspect of a company’s balance sheet and may fluctuate over time. It’s an important component because it shows the liquidity level of a customer’s debts; in other words, it provides insight into how quickly a customer pays back their debt to the company. As discussed, how to handle double-entry bookkeeping it represents the average number of days it takes for a company to receive payment for its sales. With the help of our average collection period calculator, you can track your accounts receivables, ensuring you have enough cash in hand to meet your alternate financial obligations.

Leave a Reply